Tell us about your business. What services do you provide?

We are LPL Financial Advisors at Urist Financial and Retirement Planning, Inc. in East Syracuse. We not only help our clients pursue their personal and financial goals, we also support them thru all stages of life (new job, retirement, death of a spouse, etc.). Finances are connected to so many aspects of life, so we are very invested in our clients. We take a holistic approach to financial planning, looking at all aspects of a client’s life (past, present and future).

What should people be thinking about in terms of their finances with the start of the New Year?

Set small, attainable goals, such as creating and/or reviewing your spending plan. See where you can cut or decrease expenses to increase savings into an emergency fund and/or a retirement account. Once you have reached your goals, build upon that.

How can people set themselves up for a healthy financial future?

A healthy financial future starts by living consistently within your take-home income. This includes reducing or eliminating the use of credit cards and not carrying a balance.

If you’re not in a healthy financial position, how can you improve your financial welfare?

Simple (yet often challenging) ways to improve your situation are to reduce your “extras,” such as dining out and your daily cup of Joe. If you don’t keep track of these extras, they can add up quickly before you know it.

What are some of the biggest mistakes people make with their finances?

They spend beyond their means, don’t have an emergency fund (three to six months of living expenses), delay saving for retirement and are unwilling to get real about their finances/spending habits. People can be very reluctant to talk about their finances. Oftentimes finances are totally ignored or left to be handled by the other partner/spouse. We encourage everyone to be knowledgeable of their own financial situation.

Is there anything women specifically should be doing for their financial well-being?

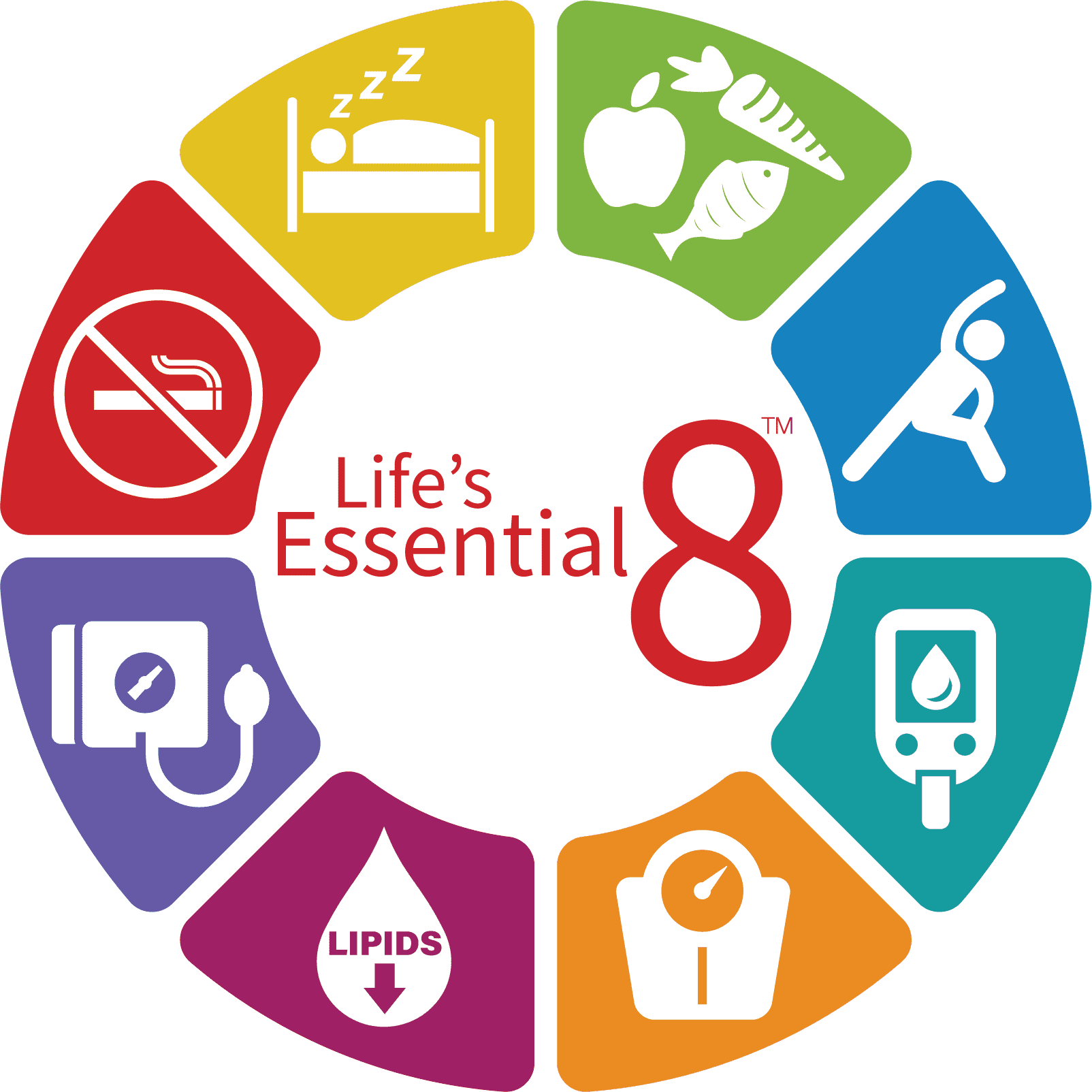

Women need to establish their own credit, have their own savings and retirement account and have enough insurance coverage (especially if they have a family). It is important to have a financial review annually, just like you have an annual medical check-up — make it a priority.

Is there anything else people should know?

There is a misconception when it comes to saving for retirement — you don’t save to just get you to your retirement date, you save to get you through the rest of your life. Finances are not something that should be feared.

How can people contact you with questions or to take advantage of your services?

We have two ways to contact us. You can give our office a call at (315) 445-2147 or email us thru our website at uristfinancial.com.

The authors of this article, Courtney Arria, CFP® and Carol Schmeiser, ChFC®, areboth LPL Financial Advisors at Urist Financial and Retirement Planning, Inc., located in East Syracuse, New York. Courtney Arria is a CERTIFIED FINANCIAL PLANNER™ practitioner and Registered Representative with LPL Financial. Carol Schmeiser is a Chartered Financial Consultant® and Registered Representative with LPL Financial. Both are dedicated to building personal connections with clients, which leads to a clear understanding of their financial needs and how she can help them to pursue their financial goals. They strive to simplify clients’ finances in order to educate and empower. Courtney and Carol can be reached at (315) 445-2147. Company information can be found at www.uristfinancial.com.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC.