Making Sound Financial Decisions

By Mary Ann Pierce

I recently met with a group to talk about investment basics. This group was a mix of people of all ages, from different backgrounds and varying professions. Every single person appeared to be confident and competent. We had a lively discussion. Relevant and interesting questions were asked. However, at one point, one of the women made a remark that just about everyone in the group echoed.

“I feel so stupid about finances and investing,” she said. “I just feel as though I should know this!”

Suddenly, this group of intelligent, capable people began to put themselves down.

Why do so many feel this way? Why should you be expected to understand all of the ins and outs of financial planning and investing? Unless it’s the course of study you chose, financial planning generally isn’t taught in schools. Finances and investing aren’t necessarily intuitive. We’re not born knowing how to save, invest and plan for our financial wellbeing.

I believe part of this stems from the myriad of advertisements we’re exposed to in media that encourage us to be “do-it-yourselfers.”

These ads tell us we can — and should — be able to navigate a labyrinth of investment option-related information to choose an appropriate investment mix of stocks, bonds, mutual funds, ETF’s, etc. And we’re told we can balance our portfolios so we can someday retire and live comfortably off our investment earnings.

Feeling overwhelmed by all of this is understandable — so is the urge to procrastinate when faced with this overabundance of information.

Then we beat ourselves up because we feel we “should” be doing all of these things, in addition to spending time at work, running our household and perhaps raising a family. It would be easy to feel incompetent.

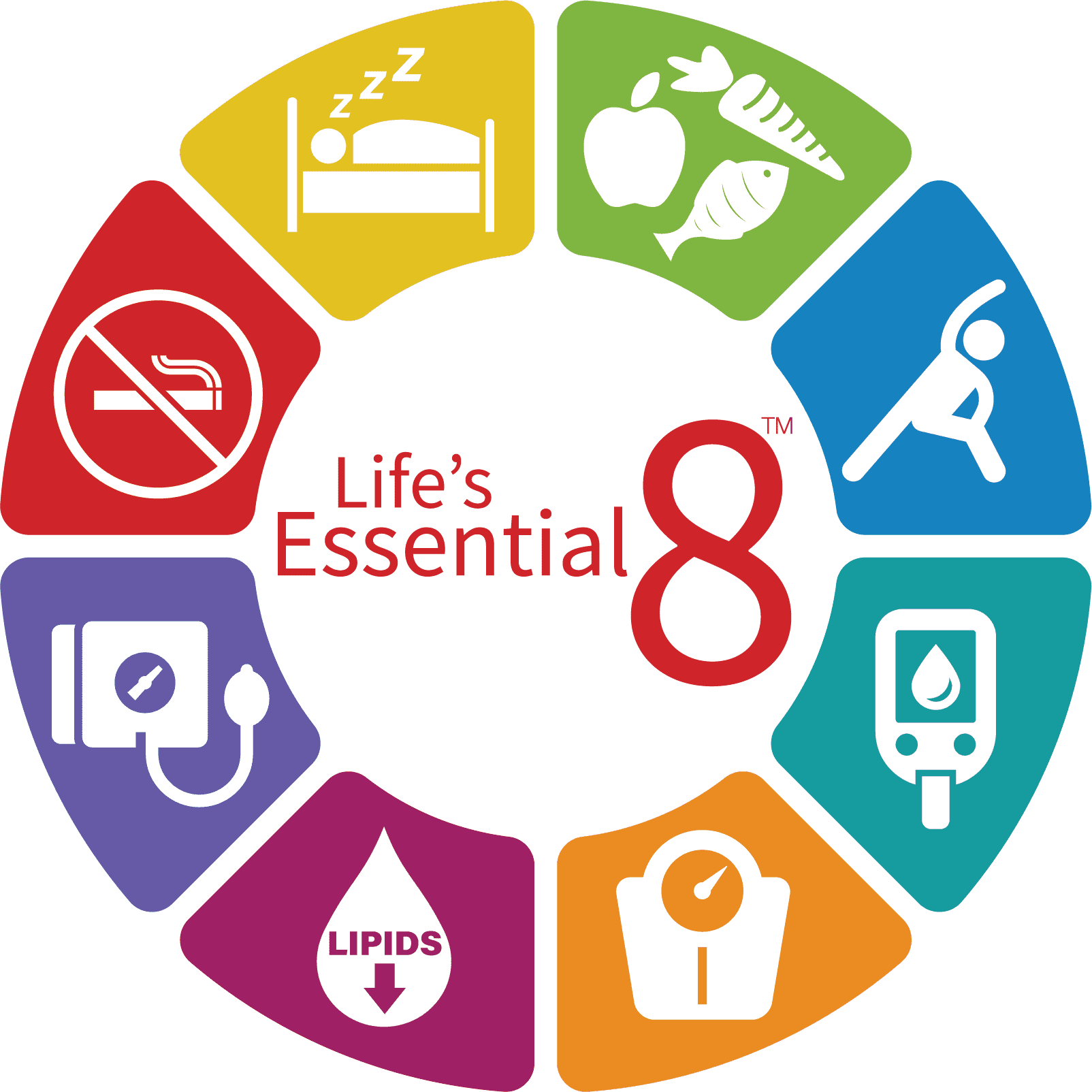

My suggestion is to learn the basics of investing; learn about different types of investments and what vehicles — such as 401(k), IRA’s, etc. — are available to help us save and invest for our future financial goals. Having a good grasp of the basics will lend a sense of empowerment and trust that we are making sound financial decisions.

I think it’s important to have a team of reliable professionals to assist in meeting financial goals. It’s important to work with an attorney to discuss your will and estate plan. Tax advisors are important to ensure we aren’t paying more tax than we’re obligated to.

It’s also important to work with an insurance and/or financial advisor to define and implement strategies for achieving financial goals. Each of these professionals will work together to ensure you have an appropriate financial and estate planning strategy.

Every one of the individuals I was speaking with had the intelligence and capability to learn about investing and financial planning if that was their desire. However, since finance wasn’t their chosen career, they didn’t have that knowledge. For them to feel they’re somehow “not smart” places unreasonable pressure to be proficient in an area that isn’t their main area of expertise.

As I said to this woman: “Let’s turn this around. Should I feel bad that I don’t understand your profession of medicine? Should I have my hand held throughout every exam and procedure and have the ‘language’ explained to me?”

Of course not. And neither should she or anyone else! SWM

Mary Ann Pierce is president of Syracuse financial advisory firm Marathon Financial Advisors. For more information, visit marathonfinancialsvc.com. Securities and investment advice offered through Cadaret, Grant & Co., Inc., member FINRA/SIPC. Marathon Financial Advisors, Inc. and Cadaret, Grant & Co., Inc. are separate entities.